city of montgomery al sales tax

What is the sales tax rate in Montgomery Alabama. 10 of tax due.

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Motor FuelGasolineOther Fuel Tax Form.

. However However pursuant to Section 40-23-7. All returns with zero tax payment should be filed with MyAlabamaTaxesalabamagov Any correspondence should be mailed to. The average cumulative sales tax rate in Montgomery Alabama is 10.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Pelham AL Sales Tax. There is no applicable special tax.

Montgomery City Sales andor Use Tax. Box 1111 Montgomery AL 36101-1111 4. This is the total of state county and city sales tax rates.

Oxford AL Sales Tax Rate. Montgomery is located within Montgomery County. Penalty - Late Payment.

Interest For questions or assistance phone 334 625-2036 3. Penalty - Late Payment. Montgomery AL Sales Tax Rate.

Northport AL Sales Tax Rate. 10 of tax. AL Sales Tax Rate.

10 of tax. Instructions for Uploading a File. 19 rows rental tax.

Penalty - Late Payment. City of Montgomery Revenue Division PO. You can print a.

The Montgomery Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Montgomery local sales taxesThe local sales tax consists of a 250 county sales tax. Taxpayer Bill of Rights. The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of food andor.

Montgomery City Sales andor Use Tax. Interest For questions or assistance phone 334 625-2036 3. Box 1111 Montgomery AL 36101-1111 4.

Sales Use Tax Division. The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250. Box 1111 Montgomery AL 36101-1111 4.

In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax. Access information and directory.

Alabama Department of Revenue. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. SalesSellers UseConsumers Use Tax Form.

Opelika AL Sales Tax Rate. 4 rows Montgomery. This includes the rates on the state county city and special levels.

The current total local sales tax rate in Montgomery AL. Montgomery City Sales andor Use Tax. Interest For questions or assistance phone 334 625-2036 3.

Mst Cpas Advisors Montgomery Cpa Firm

The Most Tax Friendly States To Retire

With Waterfront Homes For Sale In Montgomery Al Realtor Com

Why Alabama S Taxes Are Unfair Al Com

Alabama S Reliance On Sales Tax Alabama News

Gulf Shores Sues Baldwin County Over Sales Tax For Schools

Tax And License The City Of Selma Alabama

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

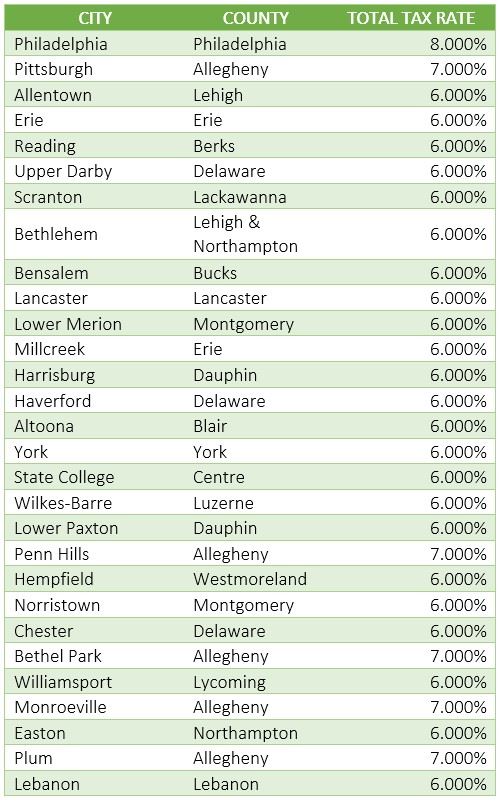

Pennsylvania Sales Tax Guide For Businesses

Montgomery Al Land For Sale Real Estate Realtor Com

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/VOGN2AILK5A2FIXKMDRE2ZUVNU.jpg)

Aldor Sales And Other Tax License Renewals Go Annual Online

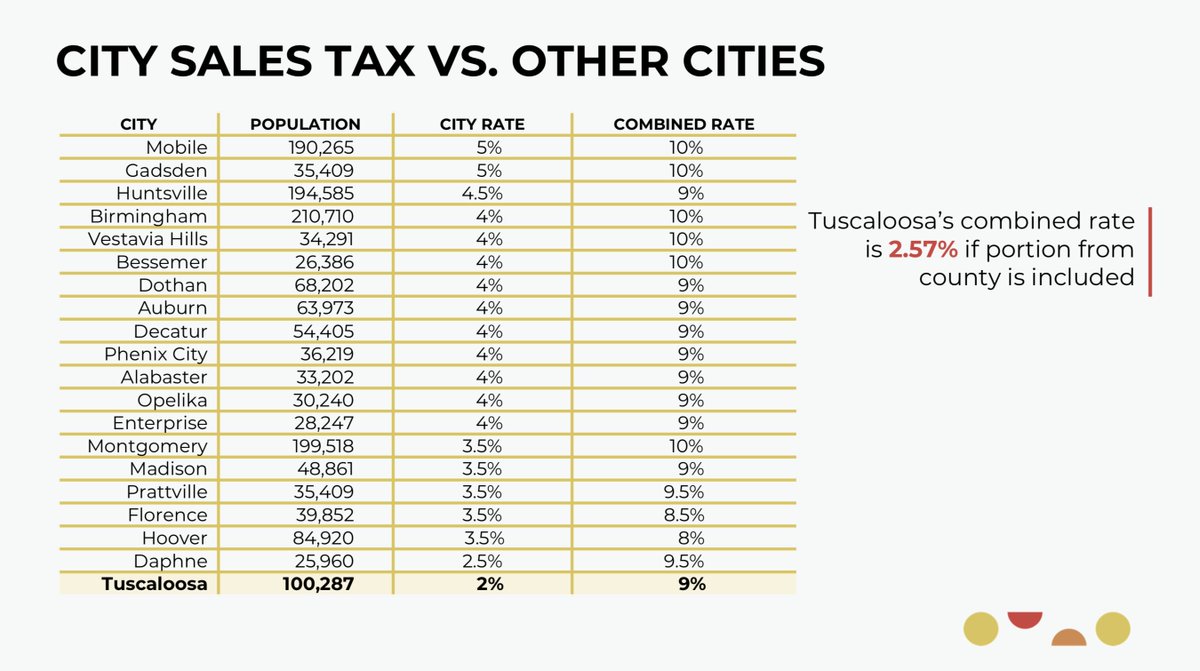

City Of Tuscaloosa On Twitter Tuscaloosa Continues To Do More With Less Having A Lower City Sales Tax Rate Than All Other Major Alabama Cities Towardtomorrow Https T Co Evsalsvway Twitter

Sales And Use Alabama Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/U3DOZBZPXNF5VNKC4OYNOIJEJA.jpg)

Montgomery S Sales Tax Revenue Is Up For The First Time In 2008

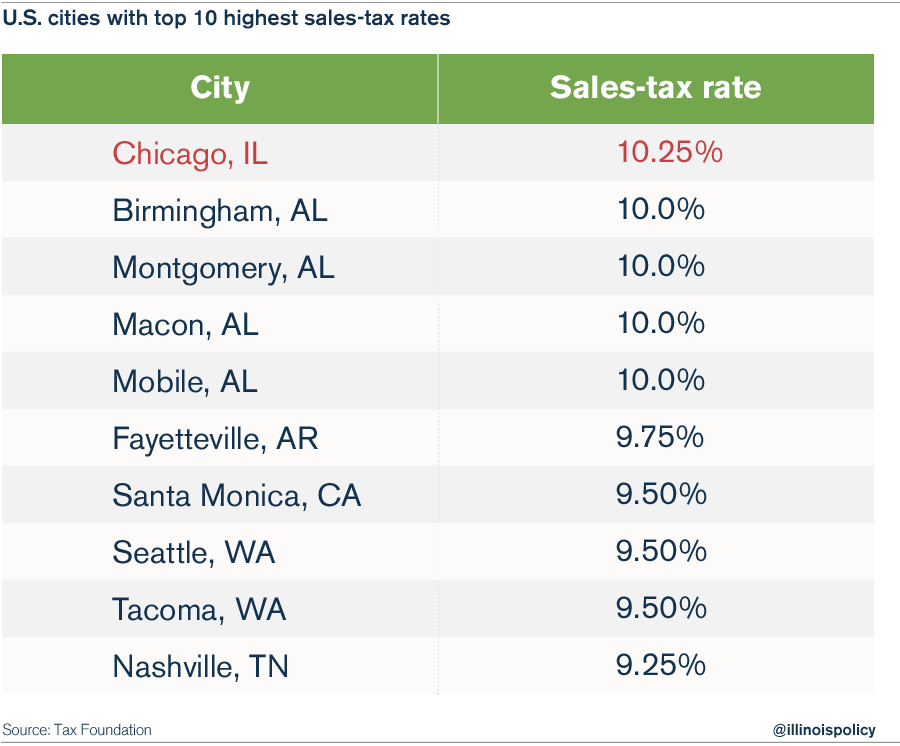

Chicago Now Home To The Nation S Highest Sales Tax

Cities With The Highest And Lowest Taxes Turbotax Tax Tips Videos

Clay Reduces Sales Tax On Groceries Making Shopping At Publix Piggly Wiggly Cheaper Al Com